What is monetisation?

In a monetisation transaction, the government is basically transferring revenue rights to private parties for a specified transaction period in return for upfront money, a revenue share, and commitment of investments in the assets. Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs), for instance, are the key structures used to monetise assets in the roads and power sectors. These are also listed on stock exchanges, providing investors liquidity through secondary markets as well. While these are a structured financing vehicle, other monetisation models on PPP (Public Private Partnership) basis include: Operate Maintain Transfer (OMT), Toll Operate Transfer (TOT), and Operations, Maintenance & Development (OMD). OMT and TOT have been used in highways sector while OMD is being deployed in case of airports.

Union finance minister Nirmala Sitharaman, while launching the National Monetisation Pipeline, said, \”It talks about brownfield assets where investment is already being made, where there are assets either languishing or not fully monetised or under-utilised.\”

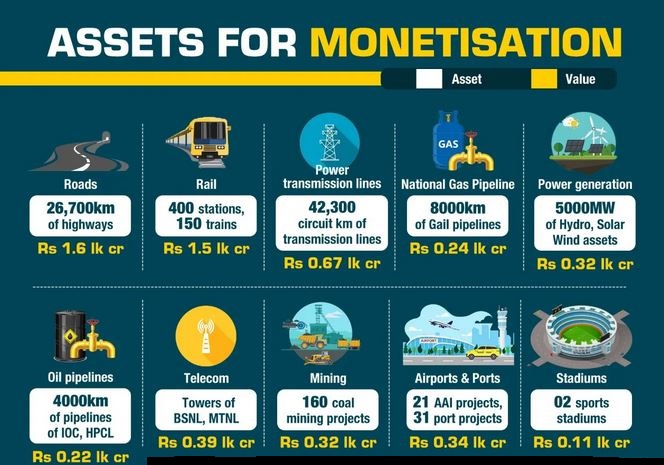

List of Assets under monetization:

The assets on the NMP list include: 26,700 km of roads, railway stations, train operations and tracks, 2,8608 Ckt km worth of power transmission lines, 6 GW of hydroelectric and solar power assets, 2.86 lakh km of fibre assets and 14,917 towers in the telecom sector, 8,154 km of natural gas pipelines and 3,930 km of petroleum product pipelines. In the roads sector, the government has already monetised 1,400 km of national highways worth Rs 17,000 crore. Another five assets have been monetised through a PowerGrid InvIT raising Rs 7,700 crore.

Challenges Face by the government employee:

A day after the Centre unveiled plans to monetise Rs 6 lakh crore worth of state assets across sectors ranging from power to road and railways Congress leader Rahul Gandhi accused the government of “selling” and “gifting” India’s “crown jewels”, created using public money over the last 70 years, to a “select few”, the CPI(M) and Trinamool Congress also slammed the move.

Government employee afraid under whom they will work under government or they will sack from their jobs because private company want to make profit. Company mainly hire employee from the third party contractor. We all knew how third party contractor work, no work paid leave, no over time paid, and they easily sack people without notice and gratuity.

Challenges Face by common People:

Government leasing the property which is acquire in 70 years by common people tax money. Are private companies run the government assets nicely? We all knew if any company put Rs. 6 lakh crore in the project they definitely want to gain profit out of it. In result hike in Electricity Bills, hike in Toll Tax, Railways fare rise etc.

We didn’t even overcome the petrol price hike, cooking oil price hike, gas price hike, salary cut due to covid-19 pandemic, most of them loss their jobs. Now if toll tax rise, electricity charges rise, railway fare rise then how common people survive.

Note: Common People asking if private sector that much capable to run government assets then what the use of government institution, Parliament also put on lease as well, we all knew much of minister not educated enough to run the State/Nation.